Referred to as one of Southeast Asia’s ‘Tiger Cub’ economies for its export-driven growth model similar to the ‘Asian Tigers’ Singapore, South Korea, and Taiwan, Vietnam continues to experience strong economic growth. This is largely driven by the government’s efforts to pursue international economic integration and implement pro-market reforms. In addition, Vietnam’s relatively cheap labor costs have enabled it to become an attractive investment destination for manufacturing.

Due to the current geopolitical environment, the country is positioning itself as an alternative for companies seeking to diversify their supply chains away from China. An important aspect of Vietnam’s foreign policy is its Three Nos: no military alliances, no siding with one country against another, and no foreign military bases on its soil. Rather than picking sides, Vietnam seeks to balance itself and forge strong relations with numerous other countries. Vietnam has formally designated seven countries as its ‘comprehensive strategic partners’: Australia, China, India, Japan, Russia, South Korea, and the United States.

As a result of its reforms, many countries now consider Vietnam to be a market economy which has helped to strengthen its global trade ties, though the US Department of Commerce recently decided to extend its current non-market status designation. The US hopes that Vietnam will continue its reforms so that it can grant non-market status. The Vietnamese government continues to enact policies designed to attract and retain more foreign investment by investing in education, pursuing free trade agreements, and improving infrastructure towards the goal of spurring further growth.

A close review of investments and trade flows show strong economic vitality and highlights two opportunities. First, there is an opportunity for greater US investment in Vietnam as its investment in Vietnam lags strategic partners and competitors alike. Second, that the robust trade between the US and Vietnam is imbalanced with significant Vietnamese exports to the US but scant imports from the US to Vietnam. Balancing this trade could be an opportunity to unlock greater US investment.

Foreign Direct Investment Driving Economic Growth

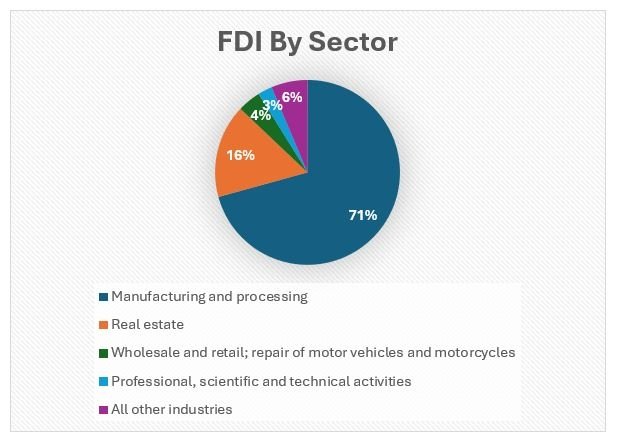

In the first six months of 2024, total newly registered capital in Vietnam reached $15.2 billion representing a 13.1% increase year-over-year. FDI is mostly concentrated in the processing and manufacturing sector, representing 70.4% of total FDI and increasing 26.3% year-over-year. Real estate, wholesale and retail sectors make up most of the remaining FDI. Vietnam’s economy is predicted to grow 6.0-6.5% in 2024. FDI contributes roughly 22% of GDP and employs 8.5 million people or roughly 23% of Vietnam’s workforce.

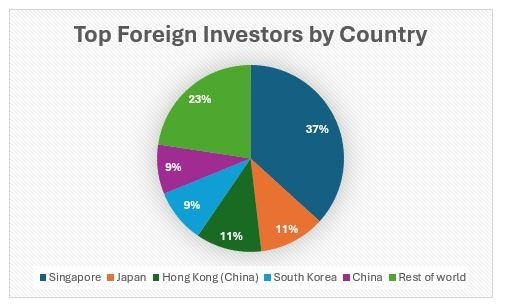

Investors from other Asian countries account for the largest sources of FDI with the top five investors being Singapore, Japan, Hong Kong (China), South Korea, and China. These countries make up 73.7% of newly registered projects. As of June 2024, Singapore represents the largest source of foreign investment by total registered capital. Singaporean investments are largely concentrated in the real estate sector in addition to manufacturing and infrastructure with increasing attention being paid to healthcare. It should be noted that the US and other Western nations often favor investing in regional countries through Singapore so that its investment is a proxy for that be the US and like minded countries.

Japan currently ranks second for FDI in Vietnam and is investing in numerous sectors including manufacturing, services, and energy. Major Japanese investors include Mitsubishi and Canon. In addition, Japan is also one of Vietnam’s major providers of official development assistance (ODA). Since 1992, the Japan International Cooperation Agency has provided over $23.5 billion in financial aid. In March, Japan’s Mitsui stated it would invest $560 million to develop a gas field in conjunction with the state-owned Vietnam Oil and Gas Group.

South Korea is also a major investor in Vietnam. Samsung is Vietnam’s largest foreign direct investor, and is a driving force in Vietnam’s burgeoning high tech assembly and manufacturing sector. The company invested $1.3 billion in main board and electronic component manufacturing in 2013. By 2021, Samsung’s investments reached $18 billion. The company currently has six manufacturing plants and is building a new R&D center in Hanoi. Nearly half of Samsung’s smart phones are produced in Vietnam. In August 2022, Samsung announced plans to invest additional $3.3 billion to manufacture semiconductor components in Vietnam. Hana Micron, which specializes in chip packaging and assembly, is currently building a second factory and announced plans to invest $1 billion by 2025. These endeavors have placed South Korea as the leading semi-conductor investor in the country.

How the US and China Measure Up

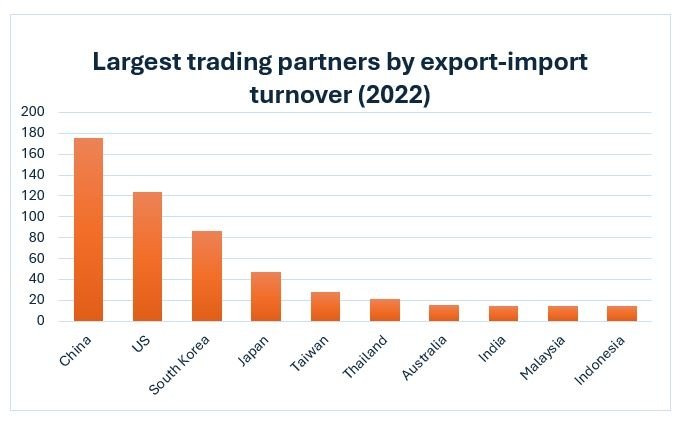

China is Vietnam’s largest trading partner. Mainland China currently ranks fourth in FDI, although if included with Hong Kong the country ranks second. Chinese capital is largely concentrated in the processing and manufacturing industry. Many Chinese manufacturing companies have shifted and expanded operations to Vietnam to take advantage of lower labor costs, however many of the manufacturing firms still rely on Chinese supply chains. Vietnam is also heavily reliant on parts and components produced in China for its own manufacturing. In 2023, intermediate goods accounted for nearly 70% of trade between both countries.

In response to US tariffs, many Chinese firms have moved their operations to Vietnam to avoid tariffs by taking advantage of the “Made in Vietnam” brand. However, this had led to accusations that China is abusing Vietnam’s rules of origin by exporting finished products from Vietnam despite little to no value being added there. This is especially the case of solar panels, in which the US Commerce Department determined that several Chinese solar panel companies were exporting to the US from Vietnam despite little manufacturing taking place in Vietnam. Recognizing this, the US has warned that it might impose sanctions against Vietnam if it is found to be allowing China to violate tariff laws.

Chinese FDI in manufacturing often uses labor-intensive production and low-end technologies to leverage Vietnam’s cheaper labor costs. However, the use of outdated Chinese technology leads to high energy consumption, low productivity, and inefficiency. This has raised concerns that Vietnam is falling into a premature deindustrialization trap, whereby before completing its industrialization, Vietnam may see its manufacturing sector diminish.

While Vietnam has cooperated with China on some infrastructure investment, mostly centered around energy, the country has been reluctant to join China’s Belt and Road Initiative. This is largely due to concerns about sovereignty regarding Chinese political and cultural influence, construction practices favoring Chinese firms and labor, and concerns about being saddled with debt. Disquiet related to threats to sovereignty and overreliance on China has led Vietnam to pursue closer trade ties with other countries, including the US. Vietnam’s decision to upgrade its relationship status with the US to ‘comprehensive strategic partner’ demonstrates its desire to strengthen bilateral cooperation.

In 2023, the US was Vietnam’s second largest trading partner. Most of the trade comprises of exports from Vietnam to the US, with Vietnam now having the fourth largest trade surplus with the US behind China, Mexico, and the EU. This trade deficit has grown 250% since 2018 when tariffs were placed on Chinese goods causing exports from Vietnam to increase.

Despite strong trade ties, US direct foreign investment in Vietnam lags many countries in Asia, though as noted above, significant US investment flows through Singapore. As of June 2024, the US ranks as the 13th largest direct investor in the country. US investment is mostly concentrated in the accommodation and food service industries, with manufacturing and processing in second place, representing 42.3% and 20.3% of registered capital respectively.

The US’ largest FDI project is currently a 5-star resort and entertainment venue in Ba Ria owned by Winvest Investments. Other US companies investing in Vietnam include Apple, Intel, Citigroup, Nike, Chevron, Ford, Coca-Cola, and KFC. P&G Group has announced plans to invest $100 million to expand factory production, and other large US companies plan to invest in sectors ranging from renewable energy to technology.

American semi-conductor manufacturers have a growing presence in Vietnam. In 2021, Intel invested $475 million to build a chip assembly and testing facility in Saigon Hi-Tech Park. This follows the Intel’s existing $1.5 billion manufacturing plant in Ho Chi Minh which opened in 2010. The plant in Ho Chi Minh is Intel’s largest for assembling, packaging, and testing chips. Since 2010, the plant has shipped over 3 billion product units and employs 2,800 people. In 2023, Amkor unveiled a new $1.6 billion factory, and Marvell announced it would also build a semiconductor design center in the country. Nvidia has invested $250 million in Vietnam and plans to increase its presence. Despite the growth in investment, Intel backed out of a planned $1 billion expansion in Vietnam, signaling that some limitations remain.

Where India Fits In

India ranks as Vietnam’s eighth largest trading partner, and is the ninth largest source of FDI by number of projects in 2023. Bilateral trade and investment have been growing in recent years spurred by Indian investment projects which are primarily concentrated in the energy and agricultural sectors. India’s Tata Power has been active in building geothermal and solar power projects in the country. Indian investment has also been expanding to infrastructure projects. Recently, India’s Adani Group obtained approval to develop a port in Danang and is planning to build an industrial park complex at the port. In addition, the Adani Group is reportedly considering investing in two airports in Vietnam. Pharmaceuticals and the IT sector are also growing areas of investment.

Trade and investment between India and Vietnam is facilitated through the ASEAN-India Free Trade Area. As with other countries, Indian investment in Vietnam is driven by inexpensive labor and a desire to diversify its supply chain from China. Vietnam classifies India as a Comprehensive Strategic Partner and both countries have been strengthening defense ties.

Strategic Industries

Semi-conductors

Vietnam’s semiconductor industry possesses strong growth prospects. By the end of 2024, Vietnam’s semiconductor industry is expected to reach over $6.16 billion in value. Currently, the country’s semiconductor industry is mostly limited to assembly, testing and packaging of semiconductor components, however it is looking to develop its own domestic design and manufacturing capabilities.

Some structural issues prevent Vietnam from realizing its full potential. One of the primary challenges is energy insecurity. Blackouts due to summer heat have forced factories in industrial parks in northern Vietnam, where many manufacturing and high-tech companies are located, to shut down for hours at a time. This is due to Vietnam being heavily dependent on hydropower dams which can dry up during the hottest months of the year.

Another issue is a lack of skilled workers. To meet demand, Vietnam is investing heavily in increasing the number of university graduates specializing in the industry. The government aims to train 50,000 by 2030. Concerns over Vietnam’s workforce limitations led the US government to pledge $2 million during President Biden’s visit last September to support joint semiconductor workforce development initiatives to grow Vietnam’s semiconductor industry.

Pharmaceuticals

Vietnam’s pharmaceutical industry has strong growth potential owing to cheap domestic labor, and favorable domestic demand due to its fast-growing middle class. However, due to a lack of research and investment capabilities, domestic pharmaceutical production is mostly centered on generic drugs and medications. This presents an opportunity for foreign companies to partner with domestic producers to produce more specialized medications, although high barriers to entry prevail.

While foreign companies face heavy restrictions in Vietnam, the country’s Ministry of Health drafted an amendment to its pharmacy law to propose new incentives for FDI. This includes granting many of the same rights enjoyed by domestic firms to foreign ones. As a result, foreign companies would be allowed to carry out research, import raw materials, conduct clinical trials, and engage in wholesale of drugs to retailers, among other things.

Telecommunications

High entry barriers confront foreign investors in Vietnam’s telecoms industry resulting in the industry being dominated by domestic firms. Foreign investment in the industry has been allowed only through joint ventures, partnerships, or purchasing shares. Foreign investors are however allowed to own all undersea fiber optic cable transmission capacity and sell that capacity to licensed telecommunications providers in Vietnam.

Vietnam’s government has recently signaled intent to open the telecoms industry to foreign competition by introducing provisions to its Telecom Law which came into effect on July 1, 2024. These provisions allow 100% ownership by foreign companies in cloud computing, data center and internet telecommunications services.

Infrastructure Projects

Vietnam’s extensive infrastructure projects, including port infrastructure, present opportunities for foreign investors. The planned Cai Mep Ha Logistics Center as part of the Cai Mep-Thi Vai port system is one such example. This logistics center is set to be developed by Vietnam’s Gemadept Corporation and Seattle-based port operator SSA Marine.

Vietnam’s government is seeking to position the port of Cai Mep as a major logistics center as the Cai Mep-Thi Vai port system is the only one in the country capable of accommodating ships carrying containers directly to Europe and North America without transshipment through another country. The development of adjacent free trade zones and industrial parks have the potential to unlock more trade and investment opportunities.

Opportunities for Increasing Trade and Investment

More can be done to increase trade and investment between the US and Vietnam.

On the US side, this includes joining multinational trade agreements of which Vietnam is a member. The US joining the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) would be a significant step in this directrion.Comprising of Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore, and Vietnam, the trade bloc accounts for 15.6% of global GDP which makes the agreement one of the largest free trade areas by GDP. The CPTPP includes standards for intellectual property and digital trade that could help facilitate more high-tech investment in Vietnam, helping to develop the country’s semiconductor industry which would benefit the US as it seeks to diversify its semiconductor supply chain.

Chinese trade with Vietnam is already strengthened through the ASEAN-China Free Trade Area. China has applied to join the CPTPP, which if accepted would further bolster its trade and investment ties with its members. To most effectively compete with China on trade and investment in the region, the US should seek to join the CPTPP.

The Indo-Pacific Economic Framework for Prosperity (IPEF) also presents an opportunity for a stronger economic relationship. While not a traditional free trade agreement, the initiative is designed to strengthen economic ties through four pillars: (1) selected trade issues; (2) supply chains; (3) clean energy, decarbonization, infrastructure; (4) taxation, anti-corruption. While agreement on the final three pillar have been reached, finalization of the trade pillar in unfinished with the path forward uncertain. Ideally, a concluded agreement would include commitments to mutal market access and strong provisions on digital trade.

Apart from trade agreements and similar initiatives, the CHIPS Act has potential to increase US trade with Vietnam, specifically in the semiconductor industry. As part of the Act, $500 million is allocated to the International Technology Security and Innovation (ITSI) Fund to enhance US and partner capabilities in digital infrastructure and semiconductors. Some of these funds could be used to assist Vietnam in developing its nascent semiconductor industry to strengthen US supply chains. This in turn would unlock more trade and investment.

On Vietnam’s part, addressing bureaucratic hurdles including a lack of transparency and clear regulatory requirements are barriers to increasing investment could attract greater US investment. This has been cited by some foreign investors as reasons for not pursuing further investment in the country. This indicates there is more room for improvement in Vietnam’s market and regulatory reforms. To improve investor confidence, Vietnam could more clearly define which government departments have jurisdiction over foreign investment and regulatory affairs, as well as implement appropriate legal frameworks to protect foreign investors. This is especially relevant to intellectual property, where lack of coordination among ministries and agencies responsible for enforcement, reliance on administrative enforcement, and lack of familiarity with intellectual property law have led to poor intellectual property protection and enforcement.

Also, as a country that relies on significant exports to countries like the US, it would be prudent for Vietnam to continue to explore ways to balance such trading relationships by considering categories where it importing would be mutually beneficial.

Collaborative Efforts Can Strengthen Ties

Vietnam would benefit from a robust policy to attract intellectual capital from the US, which is essential for advancing the semiconductor industry and the AI-driven economy, as well as improvements to other key sectors. Outside of private enterprise and federal investments, special relations between cities, such as Nha Trang, Khanh Hoa and Boston, Massachusetts, can also play a role in this effort. By collaborating on pioneering events and initiatives focused on semiconductors, AI, and digital technology, these cities can draw financing and capital to Vietnam, positioning it as a potential player in the global tech economy and enhancing its security with regards to China. This is an opportunity for Vietnam to balance its trading relationship with the US as well.

Conclusion

US investment in Vietnam faces both challenges and opportunities. Increased economic liberalization is creating more opportunities for US companies to expand their operations in Vietnam. The decision by the Vietnamese government to formally upgrade its relationship with the US demonstrates that it views the US as an important partner and is seeking to deepen and broaden its bilateral relationship. Even as this is partly driven by Vietnam’s weariness of China as it seeks to forge strong relations with other countries, it also reflects the attractiveness of access to the US market and its technology for driving further growth.

Even as it defers designating it as a market economy, the US should continue to be steadfast if being a partner on the path of positive reform. Continued market opening by Hanoi can facilitate increases in FDI as well as future market economy designation. This could include following through on commitments to grow Vietnam’s high-skilled workforce to meet the labor demand of foreign investors, continuing pro-market reforms, and improving regulatory transparency. In addition, Washington can help facilitate more trade and investment by joining trade blocs and enhancing existing initiatives.

Cosponsored by the Boston Global Forum

Author

Wahba Institute for Strategic Competition

The Wahba Institute for Strategic Competition works to shape conversations and inspire meaningful action to strengthen technology, trade, infrastructure, and energy as part of American economic and global leadership that benefits the nation and the world. Read more