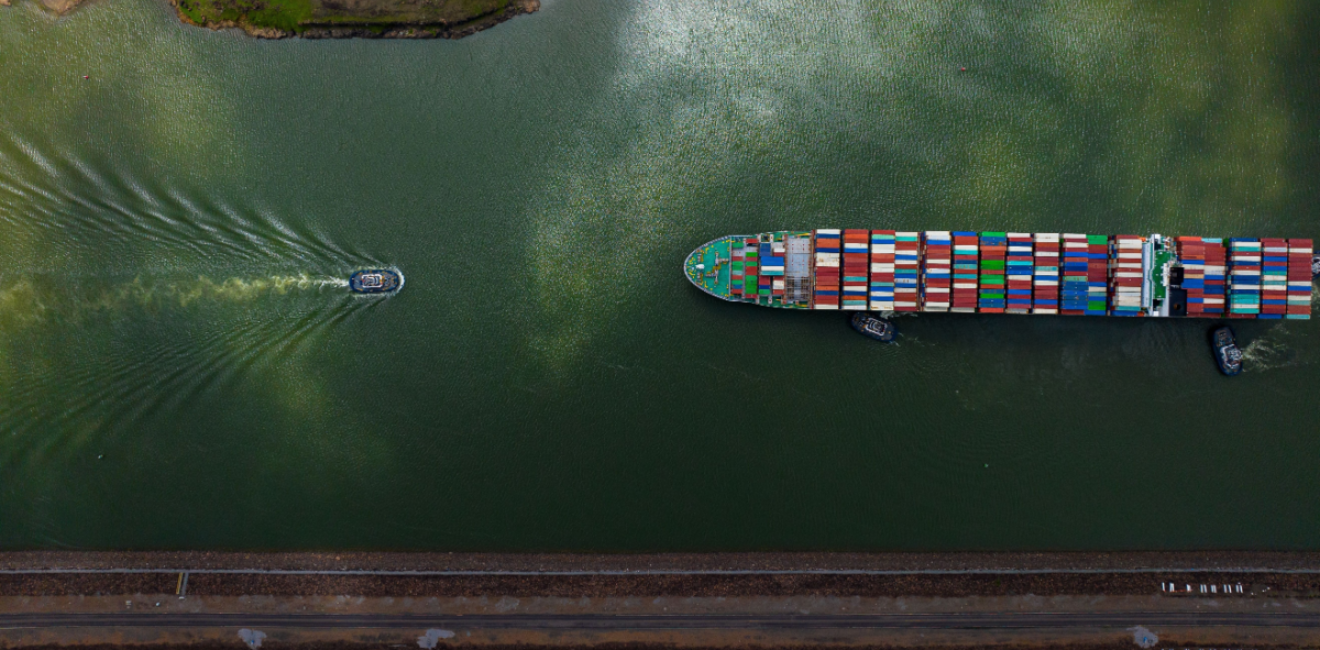

A BlackRock-led consortium and CK Hutchison announced that the consortium would acquire Hutchison Port Holdings’ (HPH) “90% interests in Panama Ports Company.” Through the Panama Ports Company, Hutchinson owned and operated the ports of Cristobal and Balboa at the Panama Canal through concessions since 1997—most recently renewed in 2021.

CK Hutchison’s stakes near the Panama Canal came under recent scrutiny, especially among US government officials and lawmakers, due to concerns over China’s level of control at the canal. This scrutiny led Panama to consider withdrawing from China’s Belt and Road Initiative and cancelling the concessions.

This historic announcement will allow US based BlackRock and Global Infrastructure Partners, in partnership with Switzerland based Terminal Investment Limited and MSC, to step in at the Panama Canal at a crucial time for global economic security. As Chinese and Hong Kong companies—such as COSCO, China Merchant Ports, and Hutchison—are invested already in over a hundred ports and maritime chokepoints across the globe, this acquisition will allow this American-European private consortium to gain a stronger foothold at global ports.

But this announcement does not stop at the acquisition of HPH’s interests in Panama Ports Company—the two sides also announced that the consortium will purchase “CK Hutchison’s 80% effective and controlling interest in subsidiary and associated companies (the “HPH Transaction”) owning, operating and developing a total of 43 ports comprising 199 berths in 23 countries, together with all HPH’s management resources, operations, terminal operating systems, IT and other systems, and other assets appertaining to control and operations of those ports (the “HPH Ports Sale Perimeter”).

HPH’s stakes at global ports span all across the globe, with stakes at ports such as Freeport (Bahamas), Gdynia (Poland), London Felixstowe (UK), and Port Klang (Malaysia). This announcement is not only opening a gap for transatlantic investors to step in, but also a floodgate for US stakeholders at ports and allowing them to play catch-up vis-a-vis China.

While CK Hutchison will hold onto its ports in China and HPH Trust, this agreement covering 43 overseas ports comes as a surprise. Access to ports is critical for maritime commerce, and China has long invested into cementing such a global network. Such a commercial deal comes with profound geopolitical implications.

While American investment through BlackRock was galvanized by this scrutiny and investigation into the Panama Canal, this acquisition will hopefully position the US private and public sector to make future investments at other global ports. This agreement not only further strengthens US partnership with European stakeholders, such as Terminal Investment Limited and MSC, but it will also position the US to compete credibly with China for global maritime influence.

Author

Wahba Institute for Strategic Competition

The Wahba Institute for Strategic Competition works to shape conversations and inspire meaningful action to strengthen technology, trade, infrastructure, and energy as part of American economic and global leadership that benefits the nation and the world. Read more

Explore More

Browse Insights & Analysis