China’s latest military exercises near Taiwan, during which it simulated a full-scale attack, just gave the US even more reason to diversify its supply chains.

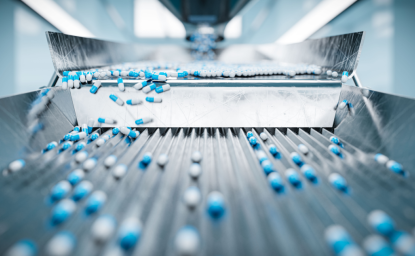

While China’s saber rattling may be performative, it serves an important reminder. If a “Taiwan contingency” was triggered today, it would leave the US desperately short of goods vital to economic security, including pharmaceuticals, critical minerals, and semiconductors. And while many economies in Southeast Asia already provide alternative sources of supply, uncertainty in the region means the US must also cultivate supply chains outside the “weapons engagement zone,” the area within immediate reach of China’s vast missile arsenal.

Luckily, there are opportunities to diversify much closer to home. But taking advantage of them requires a shift in US policy toward more active engagement with strategic partners throughout the Americas.

The current US strategy for “de-risking” trade is simply to move as much production back home as possible. The government has already offered a variety of financial incentives, including grants and loans under the CHIPS Act, to reshore semiconductor production. Those efforts, along with tariffs and other trade barriers, are designed to make it more viable financially to manufacture critical goods in the US.

However, efforts to reshore production run up against two problems.

First, the US doesn’t have the labor it needs to produce everything at home. Skills shortages have already delayed the opening of semiconductor fabrication plants, such as TSMC’s operation in Arizona. And even where skills are not the issue, US workers are too expensive for the labor-intensive, low-margin jobs that are done more efficiently abroad. That’s precisely why many semiconductor firms globalized pieces of the production process to begin with, moving chip-conventional packaging and testing overseas, where affordable labor is more readily available.

Second, even if the US had the workers, it doesn’t always have the raw materials. Because it lacks its own deposits, the US imports at least half its supply of 44 minerals and commodities necessary for production. That list includes graphite, which has wide applications in batteries, lubricants, and, of course, semiconductors. The US gets 100 percent of its graphite from overseas—with China being the main supplier.

Given the economic realities, self-sufficiency isn’t an option. The US can’t produce everything it needs at a scale to insulate the economy from disruptions across the Pacific.

So, what can it do? One answer is that it can learn from its competitors. China didn’t become a hub of global manufacturing by investing solely in domestic capacity. It pursued an aggressive, decades-long effort to partner with countries of high strategic importance, including those with rich critical mineral reserves. China’s investments in markets across Asia, Africa, and increasingly in Latin America, have placed it in the position we see today as a center of raw materials extraction and processing.

There’s a lesson in that for the US. Rather than trying in vain to reshore everything, America must remember that its allies and partners can help guarantee its economic security—especially those in the region.

A more proactive, outward-looking strategy involves two priorities. One is trade agreements. Allies have been exasperated by the perceived uncertainty in US policy in recent years. The US must reboot trade deals to reassure its economic partners. Investments to provide new, reliable sources of supply require reliable, long-term access to America’s market. Only concrete guarantees will provide the economic incentives to align production with critical US needs.

At the same time, America’s development finance efforts should be coordinated with trade deals to help partner countries bolster capacity. China has invested hundreds of billions in trade-enabling infrastructure across emerging markets and developing countries, plugging countries into a China-centric supply network and cultivating export markets. The US already has commenced similar efforts in Africa’s Lobito Corridor and in the Philippines Luzon Economic Corridor. These efforts should be expanded, especially in the Americas.

The good news is that several new, bipartisan initiatives are moving in a positive direction.

The Americas Act seeks to (among other things) extend membership in the USMCA (US, Mexico, Canada Agreement) to additional Latin American economies. It provides a way to not just balance against China’s growing influence in Latin America and the Caribbean, but to help lock in mutual market access enjoyed under the USMCA umbrella. This could help make the US supply chain more resilient to a Taiwan contingency.

Similarly, the Semiconductor Supply Chain Security and Diversification Act looks to empower the US International Development Finance Corporation (DFC) to make larger investments in the chips supply chain in the Western Hemisphere. Specifically, it targets investments at all steps of production (from mining through chips testing and production) in countries otherwise not eligible for DFC loans. This recognizes the value of supporting strategic priorities consistent with the DFC’s development mission.

These two bills are in their early stages and their fate remains uncertain. But sponsorship from both sides of the aisle reflects a growing understanding that the US can’t go it alone. Strength always comes in numbers, and if a fight starts overseas, it will be essential for the US to have friends close to home.

Authors

Associate Professor in the School of Government and Public Policy and the James E. Rogers College of Law, University of Arizona

Wahba Institute for Strategic Competition

The Wahba Institute for Strategic Competition works to shape conversations and inspire meaningful action to strengthen technology, trade, infrastructure, and energy as part of American economic and global leadership that benefits the nation and the world. Read more

Explore More

Browse Insights & Analysis

America is Talking About Friendshoring, China is Doing It

Strengthening US-Mexico Quality Pharmaceutical Supply Chains