On October 31, 2024, the President of Mexico, Dr. Claudia Sheinbaum Pardo (CSP), published in the official gazette the decree reforming the constitution, reclassifying back Comisión Federal de Electricidad (CFE) and Petróleos Mexicanos (Pemex) as State Owned Enterprises (SOEs) reversing their status of State Productive Enterprises (SPEs), category implemented in the energy reform of 2013. The SPEs category grants them the mandate to generate value, among other things, but three key features worth focusing on to understand the potential implications of this reclassification.

- CFE and Pemex had budgetary autonomy to decide on their investments, subject to the fiscal balance established by the Ministry of Finance (SHCP), including a ceiling set for personal services. This allowed the SPEs to have flexibility in their decisions to adjust to the market conditions and improve their operations. Typically, a tight market would imply higher costs or lost revenue potential if the company is constrained in its ability to decide on the best course of action. Thus, granting them that flexibility allowed the SPEs to determine how best to seize those opportunities, improving their outlook and aligning their business practice to a competitive environment. For example, the government implemented a process where CFE contracted power through long-term public auctions open to private participants. These tenders resulted in savings of more than 70% for the SPE, between the price ceiling set in the first auction and the average price of the third one (70 USD/MWh vs. 22.4 USD/MWh), setting global prices for clean power in each of those tenders; close to 7 GW of additional renewable energy capacity; and investments for 8.6 billion USD.

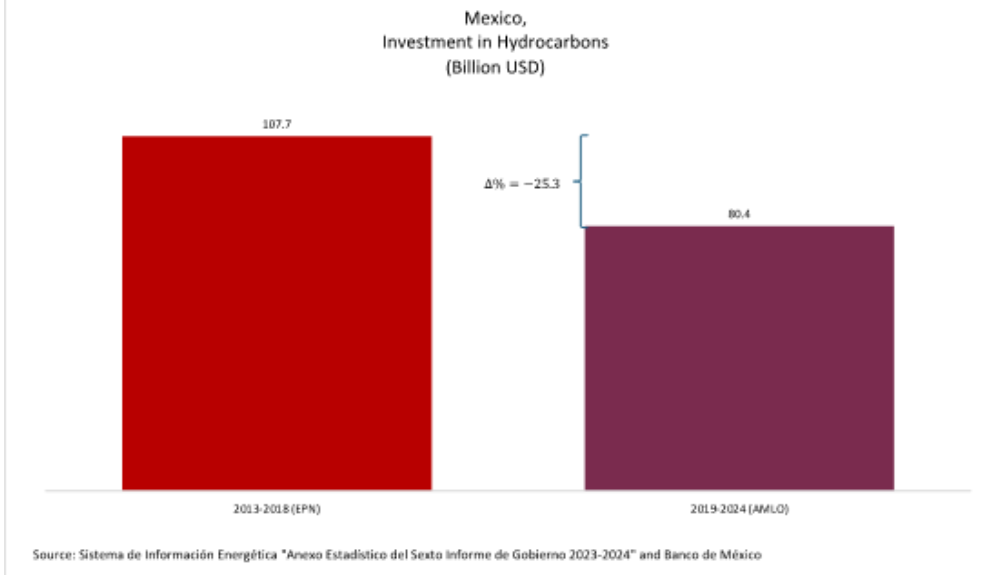

- Opening to private investment in various hydrocarbons and power segments of the value chain. This expanded the potential of the energy sector to contribute to the economic development of the country, growing the opportunities for national and international firms to invest, attract talent, develop new technologies, and create value while at the same time reducing pressure on the SPEs to be the sole providers of the entire value chain. Moreover, the government launched public tenders open to private investment to bid for oil and gas exploration and production projects, which attracted billions of dollars of investment during 2013 and 2018, while in the following administration (2019-2024), these processes were halted, and investments fell twenty-five percent (see graph).

- Sustainability as an overarching principle across the energy sector. The purpose of this mandate was to strengthen the economy's competitiveness, promote regional development, and, at the same time, contribute to reducing the environmental footprint of the energy sector. This obligation resulted in the requirement for the wholesale electricity market participants to consume an increasing share of clean power adjusted annually. This action ensured that the creation of the renewable energy market was supported by rising demand, attracting investments in different technologies, i.e., close to 7 GW of new geothermal, solar, and wind energy projects at the most competitive prices.

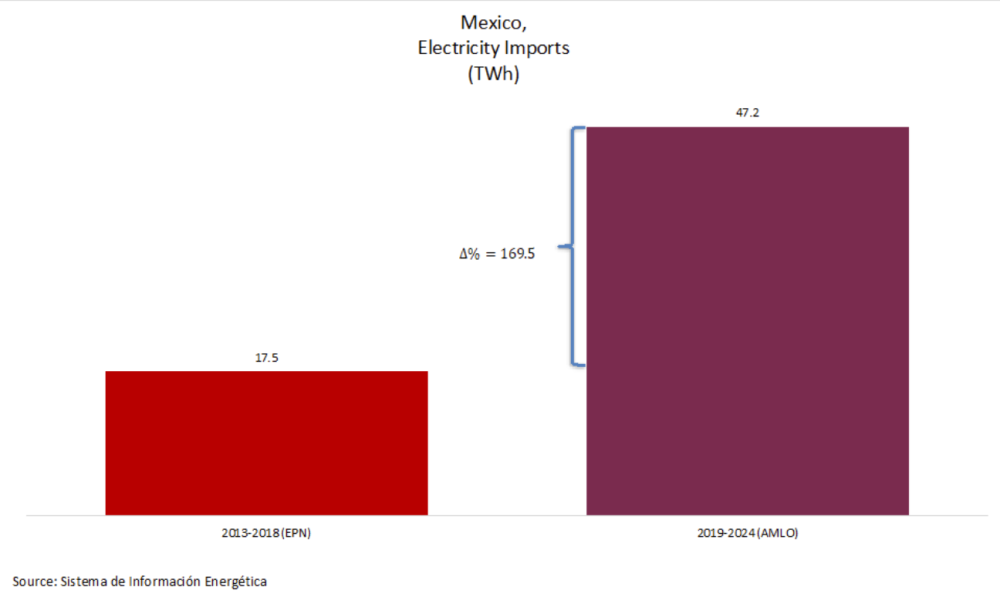

Despite this record, former President Lopez Obrador's (AMLO) considerations when submitting the initiative included strengthening the State and the SOEs to guarantee energy autonomy. However, the last administration not only did not improve its electricity production but almost tripled its power imports, going from 17.5 TWh between 2013 and 2018 to 47.2 TWh between 2019 and 2024 (see graph).

Another consideration made was prices, indicating that access to electricity as a human right should not be dependent on the purchasing power of the consumers. Therefore, the State should guarantee this through its SOEs, as they are non-profit companies. Yet, electricity tariffs for domestic consumers grew 33.4% in October of this year compared to the same month of 2018 despite energy inflation being only 15.1%.

Consequently, the potential effects of this reform could have a deteriorating impact on economic activity, mainly by increasing the risk of doing business. On one hand, a limit to private investment in the power sector implies that the supply will not be in syntony with the needs of the country, i.e., the government expects that the economy will grow in the middle of the range scenario at a rate of 2.5% per year from now up to 2038, which implies that power supply should increase around 5% per year to add 25 GW of new electric capacity by 2030. Although the recent electricity plan announced positively indicates that CFE will invest 12.3 billion USD to add 13 GW, there is a shortfall of 0.5 GW that the private sector would not be allowed to develop, according to the new rules. This artificial constraint to ensure the dominance of CFE will put a ceiling to the economic activity of the country, which potentially could result in lesser investments due to the uncertainty placed on the industry to base its decisions as a function of the financial capability of the SOE. This could result in delayed investments to ensure that the projects will meet the new rules or, even worse, find alternative locations to invest in to minimize that uncertainty.

On the other hand, CFE, according to the new electricity plan, is in charge of setting tariffs, which creates uncertainty for market participants. The dominant player could set tariffs at will, per region, per technology, per customer, or any other, and at a level that could be the case where it is impossible to recuperate investments and, therefore, drive out competition—in this manner, increasing the risk of investing in the electricity sector and limiting potential investments, which can result again in lower economic activity, given that the investor would require a higher yield to compensate for an increased risk.

In the end, lower competition reduces incentives to innovate, improve efficiency, and add new technologies, all of this at the expense of the final consumer. If the new government wants to improve economic activity, have stronger SOEs, and increase social development, limiting investments and reducing the ability of the SOEs to learn from best practices will weaken the state's capacity and diminish Mexico´s potential.

Author

Mexico Institute

The Mexico Institute seeks to improve understanding, communication, and cooperation between Mexico and the United States by promoting original research, encouraging public discussion, and proposing policy options for enhancing the bilateral relationship. A binational Advisory Board, chaired by Luis Téllez and Earl Anthony Wayne, oversees the work of the Mexico Institute. Read more

Explore More

Browse Insights & Analysis

La esencia de la infraestructura global: perspectivas del líder de la industria Matt Harris

Debunking the Patient Capital Myth: The Reality of China’s Resource-Backed Lending Practices